Wake County Property Tax Rate 2024 Increase Chart – Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation. Residential properties rose an average of 53% in tax value . You can contact the tax administration to send a duplicate if you misplaced it. The mailing address is: Wake County Tax Administration Attention: 2024 Real Estate Revaluation PO Box 2331 .

Wake County Property Tax Rate 2024 Increase Chart

Source : www.wake.gov

Raleigh Downtown | Raleigh NC

Source : www.facebook.com

Fiscal Year 2024 Adopted Budget | Wake County Government

Source : www.wake.gov

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

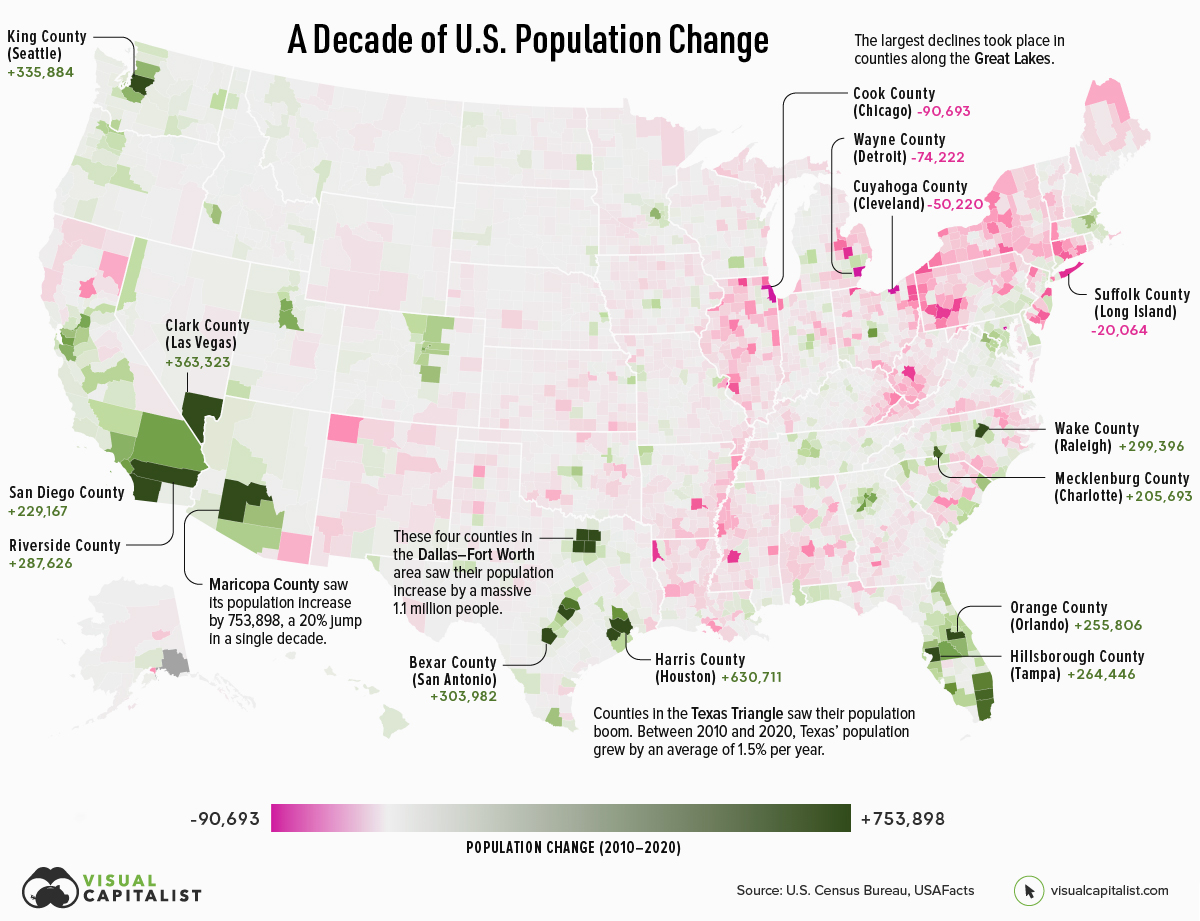

Mapped: A Decade of Population Growth and Decline in U.S. Counties

Source : www.visualcapitalist.com

Wake County unanimously passes $1.8 billion budget, property tax

Source : www.wral.com

New property value notices to hit Wake County mailboxes starting

Source : www.wake.gov

Wake County revaluations | Home, property assessments means

Source : abc11.com

Wake County homeowners brace for property tax adjustments: What to

Source : www.wral.com

How much have home prices jumped since the pandemic? The Wake Up

Source : www.cleveland.com

Wake County Property Tax Rate 2024 Increase Chart New property value notices to hit Wake County mailboxes starting : New assessments are being sent out this week, and some people are reporting their home value soared as high as 80%. . The revaluation comes at a time when the cost of homeownership is higher than we saw during the pandemic – with mortgage rates hovering around 7 percent. .